Standard deduction federal income tax 2020

Each marginal rate only applies to earnings within the applicable marginal tax bracket. IR-2020-256 November 17 2020 The Internal Revenue Service today encouraged taxpayers to take necessary actions this fall to help them file their federal tax returns timely and accurately in 2021 including special steps related to Economic Impact Payments.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Certain itemized deductions including property tax qualified charitable contributions etc.

. IRS standard deduction Earned Income Tax Credit EIC Child tax credits. Your income tax must be paid throughout the year through tax withholding or quarterly payments and reconciled yearly. The standard deduction is adjusted annually for inflation and the limits are based on your filing status.

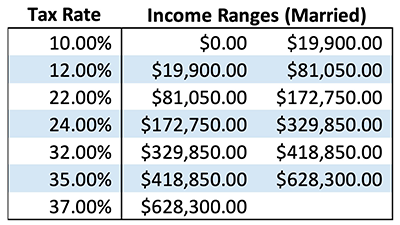

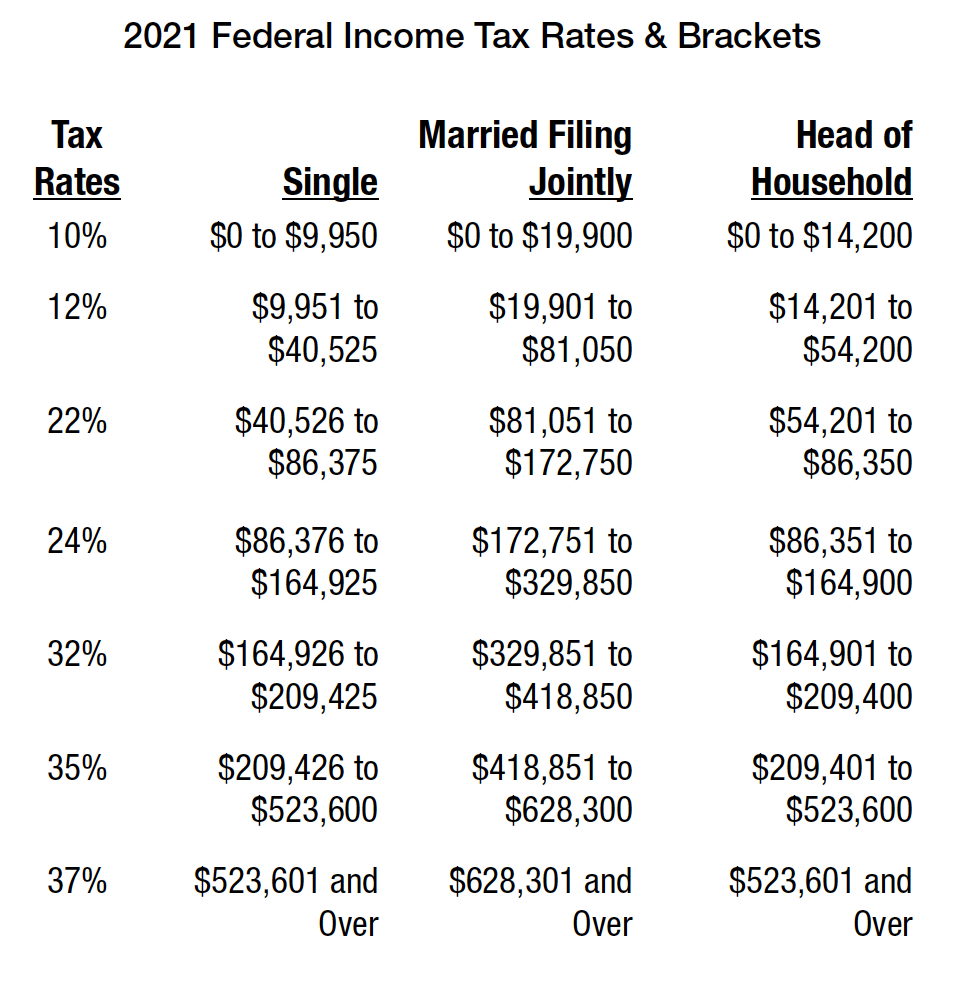

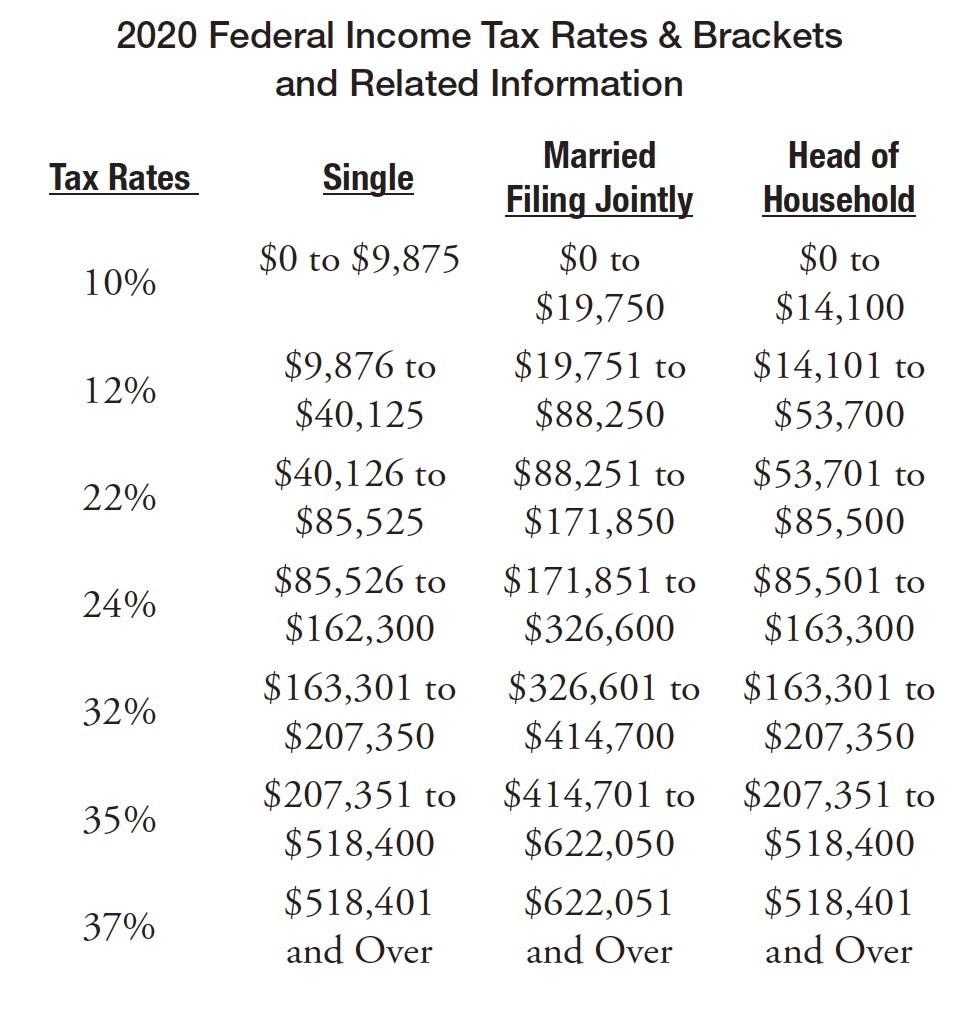

The 2020 federal income tax brackets on ordinary income. Tax filers will need the 2021 federal income tax brackets when they file taxes in 2022. Online competitor data is extrapolated from press releases and SEC filings.

Federal Tax Rates and Brackets. Exception for Married Taxpayers Who File a Joint Federal Income Tax Return. New Yorks maximum marginal income tax rate is the 1st highest in the United States ranking directly.

You have the option of claiming the standard deduction or itemizing your deductions. These standard deductions will be applied by tax year for your IRS and state returns respectively. For tax year 2021 which generally applies to tax returns filed in 2022 the amounts have increased as follows.

IR-2019-215 December 31 2019. Personally I would plan on failing to claim enough deductions to get to about 12200 or so in taxable income pay 10 on 200 or so 20 and claim the maximum health insurance premium subsidy. So people with no income increases will actually see a lower marginal tax rate.

For single taxpayers and married individuals filing separately the standard deduction rises to 12400 in for 2020 up 200 and for heads of households the standard deduction will be 18650 for tax year 2020 up 300. Standard deductions ensure that all taxpayers have at least some income that is not subject to federal income tax. There are two alternatives offered relating to the deduction either to claim the standard amount or obtain itemized deductions that youre entitled to.

No federal income tax was withheld from your childs income under the backup withholding rules. Self-Employed defined as a return with a Schedule CC-EZ tax form. Single people are allowed a 12000 standard deduction and married couples filing jointly are allowed a 24000 standard for 2018.

On federal tax returns individual taxpayers who claim the standard deduction are allowed an. No estimated tax payment was made for 2021 and no 2020 overpayment was applied to 2021 under your childs name and social security number. If you are married filing jointly or are a qualifying widower the deduction is 25100.

If you are single or married filing separately the deduction is 12550. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel. As noted above the top tax bracket remains at 37.

There are seven federal tax brackets for tax year 2022 the same as for 2021. Medicare provides hospital insurance benefits for the elderly. It also helps determine your standard deduction and tax rate.

There are -875 days left until Tax Day on April 16th 2020. The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396. 2021 Standard Deduction For Over 65 When you submit your tax responsibility the standard deduction is a benefit given to minimize your taxable income.

The rates apply to taxable incomeadjusted gross income minus either the standard deduction or allowable itemized deductions. The amount that one pays in payroll taxes throughout ones working career is associated indirectly. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Joint filers will have a 25100 deduction and heads of household get 18800. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

Unlike many other states Arkansas has no standard deduction. The additional standard deduction amount increases to 1650 for unmarried taxpayers. The Federal Insurance Contributions Act is a tax mechanism codified in Title 26 Subtitle C Chapter 21 of the United States Code.

Federal income tax brackets and related tax items are adjusted annually. New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets. A standard deduction can only be used if.

Standard deductions generally increase each year due to inflation. WASHINGTON The Internal Revenue Service today issued the 2020 optional standard mileage rates PDF used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes. The other six tax brackets set by.

Tax Rate Single Filers Married Filing Jointly. That flat amount is called a standard deduction Standard deduction basics. Filing Status Deduction Amount.

For the 2019 tax year the adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit is 116000 up from 114000 for tax year 2018. The IRS standard deduction is the portion of income that is not subject to tax and that can be used to reduce a taxpayers tax bill. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent table 1.

As a result of the latest tax reform the standard deductions have increased significantly however many other deductions got discontinued as a result of the same tax reform. Last day to file or e-file your 2020 tax return to avoid a late filing penalty and interest computed from the original due date of April 15 2021. Like the Federal Income Tax New Yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Earned Income Tax. Since the tax bill is likely to pass the first 12000 in taxable income will be within the standard deduction. The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are.

Alabama has three marginal tax brackets ranging from 2 the lowest Alabama tax bracket to 5 the highest Alabama tax bracket. Social security benefits include old-age survivors and disability insurance OASDI. Alabamas income tax brackets were last changed twelve years prior to 2020 for tax year 2008 and the tax rates have not been changed since at least 2001.

2020 Income Tax Brackets and Rates. The standard deduction rises by 50 for heads of household single and married filling separate filers. It might seem intimidating to try to calculate your federal income tax but its not necessarily as complicated as you might think.

The standard deduction for married filing jointly rises to 24800 for tax year 2020 up 400 from the prior year. About Casualty Deduction for Federal Income Tax. Income up to the standard deduction or itemized deductions is thus taxed at a zero rate.

For 2020 the additional standard deduction amount for the aged or the blind is 1300. For the most recent taxes filed for the 2021 tax year the standard deduction was 12550 for single filers and married filers who file separately. IRS Standard Tax Deductions 2021 2022.

If all this reading is not for you.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Standard Deduction Definition Taxedu Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

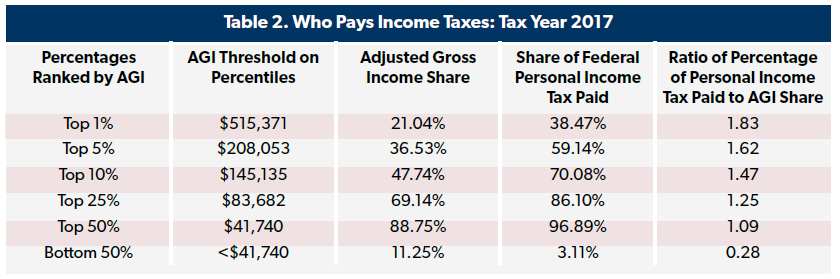

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

2021 Tax Thresholds Hkp Seattle

Inkwiry Federal Income Tax Brackets

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

What Is Schedule A H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Your Guide To 2020 Federal Tax Brackets And Rates

2021 Tax Brackets Standard Deductions Dsj Cpa

2021 Tax Brackets Standard Deductions Dsj Cpa

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition